Pesalink deposit sites in Kenya offer players a fast, secure, and locally trusted way to fund their casino accounts. As an expert who has tested and reviewed platforms across Africa, I've curated this list of online casinos that truly support Pesalink, ensuring they meet strict standards for licensing, payout reliability, and fair play. This guide is free to use and highlights only verified sites where Pesalink deposits are transparent, secure and designed to maximize convenience for Kenyan players.

Casinos Accepting Pesalink Deposits

|

Operator

|

Bonus

|

Features

|

Claim Now

|

|---|---|---|---|

|

200% Bonus

|

|

|

|

|

100% Bonus

|

|

|

|

|

100% Bonus

|

|

|

|

|

50% Free Bet

|

|

|

|

|

100% Bonus

|

|

|

|

|

Promotions

|

|

|

|

|

Jackpot Focus

|

|

|

|

|

50% Free Bet

|

|

|

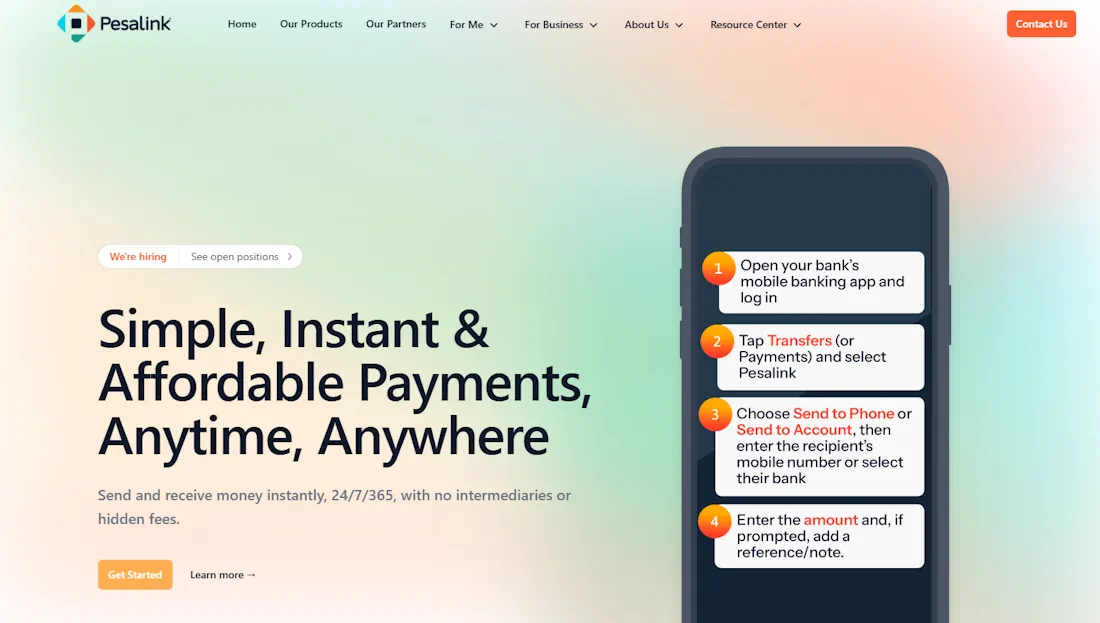

What is PesaLink and how does it work?

The Kenya Bankers Association created PesaLink in 2017 to make it easier to transfer money between banks. When I first tried it, I was amazed at how it eliminated the typical delays associated with regular bank transfers.

Real-time bank-to-bank transfers

PesaLink operates through Integrated Payment Services Limited (IPSL) and connects over 30 banks with three payment service aggregators. This allows payments to be made around the clock. Regular bank transfers can take hours or days, but PesaLink moves money in seconds - something I've seen firsthand.

The success of the system is reflected in its widespread use throughout Kenya's financial community. More than 80 financial institutions now use the PesaLink network. These include banks, SACCOs, telcos, microfinance institutions and fintechs. By December 2024, the system had processed over 1 trillion Ksh in transactions.

You can use PesaLink through:

- Bank branches

- mobile banking applications

- internet banking platforms

- USSD codes

- ATMs (where available);

Supported currencies and limits

My time with PesaLink shows that it mostly handles same-currency transfers. Some documents mention that it works with USD, GBP and EUR, but most banks stick to Kenyan shilling transactions.

The limits are quite flexible. You can send anything from KES 10 to KES 999,999 in one go. These high limits are perfect for paying rent, school fees or making business payments.

What I love about PesaLink is that it Uses mobile phone numbers instead of account numbers. No need to remember long account numbers when sending money.

Why it's different from mobile money

PesaLink is different from other mobile money services. It links bank accounts directly, so both the sender and receiver need bank accounts. This is different from mobile money platforms where anyone can send or receive money.

There's another reason why PesaLink stands out. The system started with ISO 8583 messaging, but is now moving to ISO 20022. This change helps better connect bank accounts and mobile wallets.

In my banking experience, PesaLink has been great for instant transfers without intermediaries. It goes beyond simple remittances and helps with bulk payments, rent, business disbursements and vendor payments.

Top Credit PesaLink Sites in 2026

My search for deposit options beyond regular banking led me to several betting platforms that handle credit card transactions well. These sites offer Kenyan users multiple ways to fund their accounts with simplified payment systems and PesaLink integration.

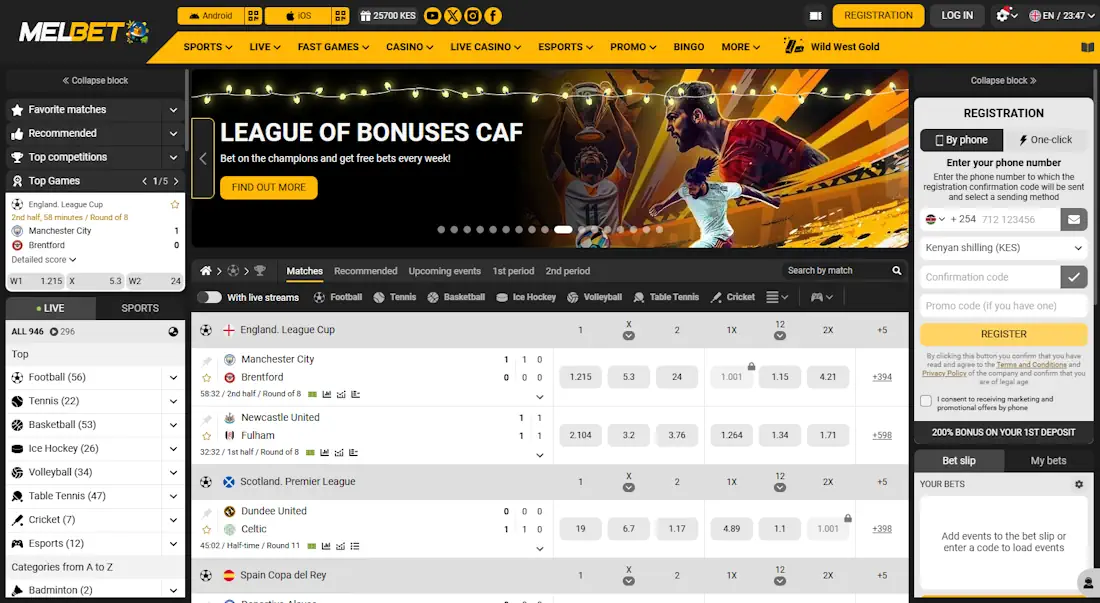

1. Melbet

Melbet caught my attention with their huge 26,000 KES welcome bonus that you can claim with the promo code "OPABET" when you sign up. The payment system works great with over 44 currencies including KES, USD, EUR and cryptocurrencies like Bitcoin and Ethereum. M-Pesa remains the top choice for Kenyan users, but PesaLink deposits work just as smoothly, giving players another reliable option.

You can start betting at Melbet with as little as 25 KES and the maximum payout goes up to an amazing 12 million KES per bet. The platform also accepts PesaLink deposits, making it a great choice for Kenyan players looking for flexible banking options.

2. Betway

Betway makes deposits easy and fast. The platform attracts many Kenyan punters with its welcome bonus that matches 50% of your first deposit and gives you free bets worth up to GHS 200 (KES equivalent).

The deposit steps are simple - log in, click on "deposit", choose how you want to pay and confirm. PesaLink deposits show up in your account instantly, while EFT transfers take 1-3 days to clear.

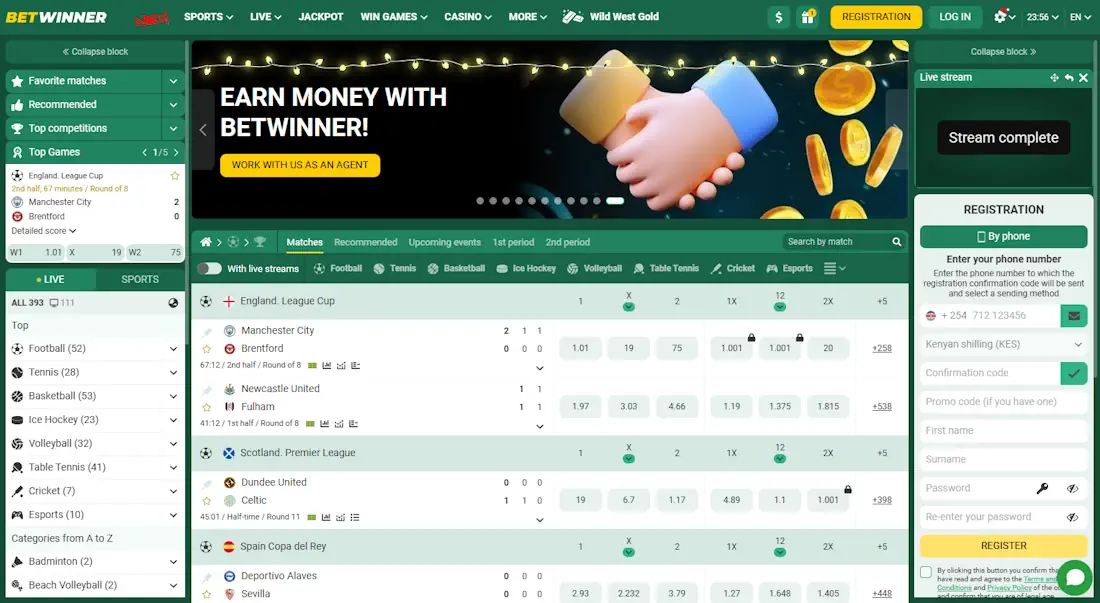

3. Betwinner

Betwinner offers new users a nice 100% welcome bonus up to 19,500 KES. The platform processes PesaLink deposits instantly so you can start betting quickly and safely.

Kenyan users who prefer mobile money can use Betwinner's M-Pesa paybill number (7011780). You can deposit between 100 KES and 70,000 KES and the money will appear in your betting account instantly.

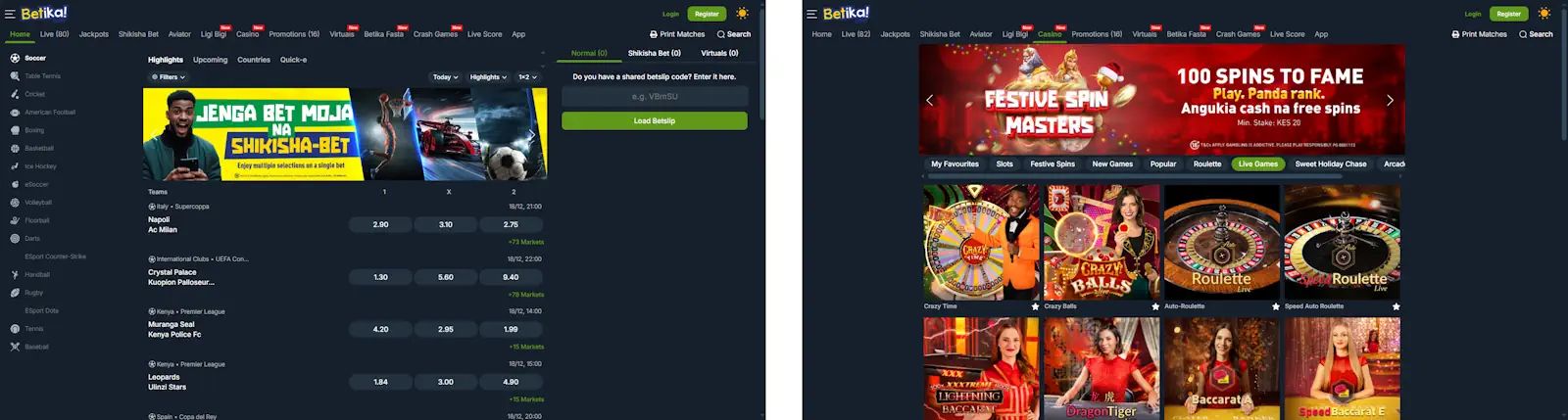

4. Betika

Betika allows Kenyans to deposit money in a variety of ways. The platform accepts PesaLink transactions with no deposit fees. They've made their system work well for local users by offering mobile money options along with regular banking methods.

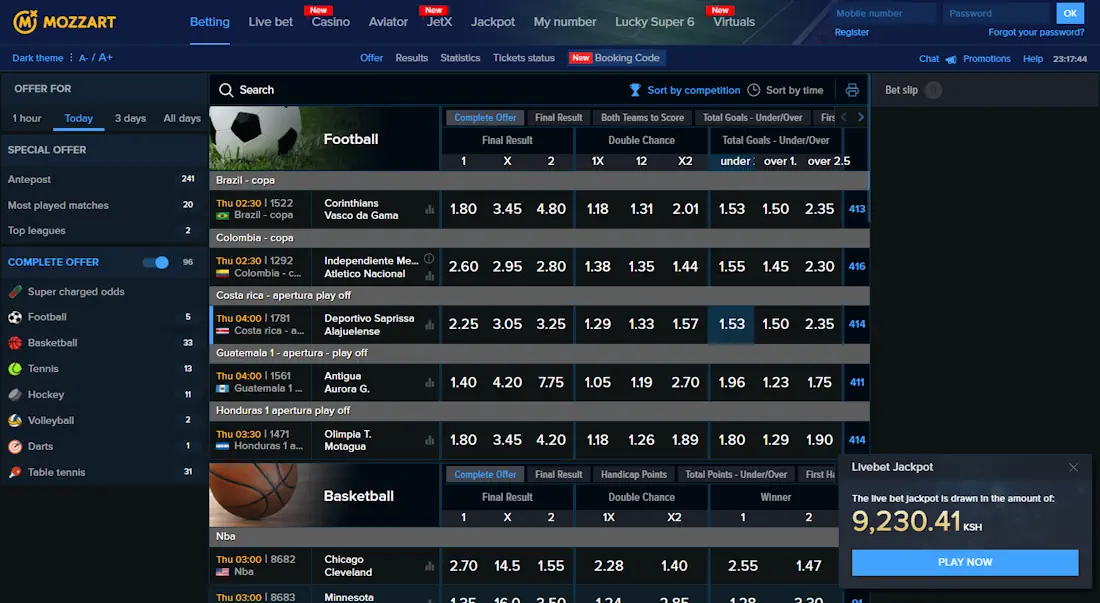

5. MozzartBet

MozzartBet completes my top five list with a 50% free bet bonus up to 2,500 KES plus 50 free spins on Aviator. Their M-Pesa payment number (290059) makes deposits easy and you can start with as little as 20 KES.

MozzartBet accepts PesaLink deposits with no fees and your money will show up instantly. The mix of banking options makes this platform a great choice for Kenyan players looking for easy deposit methods.

Where can you deposit using PesaLink?

Banking is now available to more people thanks to PesaLink's extensive network in Kenya. The service connects many financial institutions, making it quick and easy to transfer money between banks.

List of major banks supporting PesaLink

Mobile apps and online banking platforms

Digital channels give users the most convenient PesaLink experience. Almost all partner banks allow customers to use PesaLink through their mobile banking apps. For example, Standard Chartered Bank offers PesaLink through their online banking platform and mobile app. KCB provides access through their KCB mobile banking app and KCB internet banking website. Co-operative Bank customers can use the MCo-op Cash app.

USSD codes for different banks

People without smartphones can still use USSD codes. KCB customers simply need to dial *522# and follow the instructions. Co-operative Bank customers can dial *667# to access MCo-op Cash USSD and select the PesaLink menu. Standard Chartered also offers USSD access.

ATM and branch-based deposits (if available)

Several banks offer PesaLink services through physical locations. KCB offers PesaLink at ATMs and branches across the country. Co-operative Bank customers can use Co-op Bank ATMs by selecting 'Other Transactions' followed by 'PESALINK'. Most participating banks offer branch services, with Co-op Bank specifically listing its branches as PesaLink access points.

Table: PesaLink deposit sites in Kenya

| Category | Examples of PesaLink Partners |

|---|---|

| Major Banks | Equity Bank, KCB, Co-op Bank, ABSA, NCBA, Standard Chartered |

| Other Banks | Kingdom Bank, Gulf African Bank, Credit Bank, Family Bank |

| MicroFinance | Caritas Microfinance, KWFT Bank |

| SACCOs | Amica Sacco |

| Telcos | Safaricom, T-Kash |

| Fintech Partners | Pesapal, Cellulant, Ipay, Interswitch, Onafriq |

This extensive network makes PesaLink one of the most available money transfer services in Kenya, with 24/7 access through multiple channels.

How to deposit money using PesaLink

It only takes a few simple steps to make a PesaLink deposit, no matter which channel you choose. My banking experience has shown me several ways to send money instantly through Kenya's banking network.

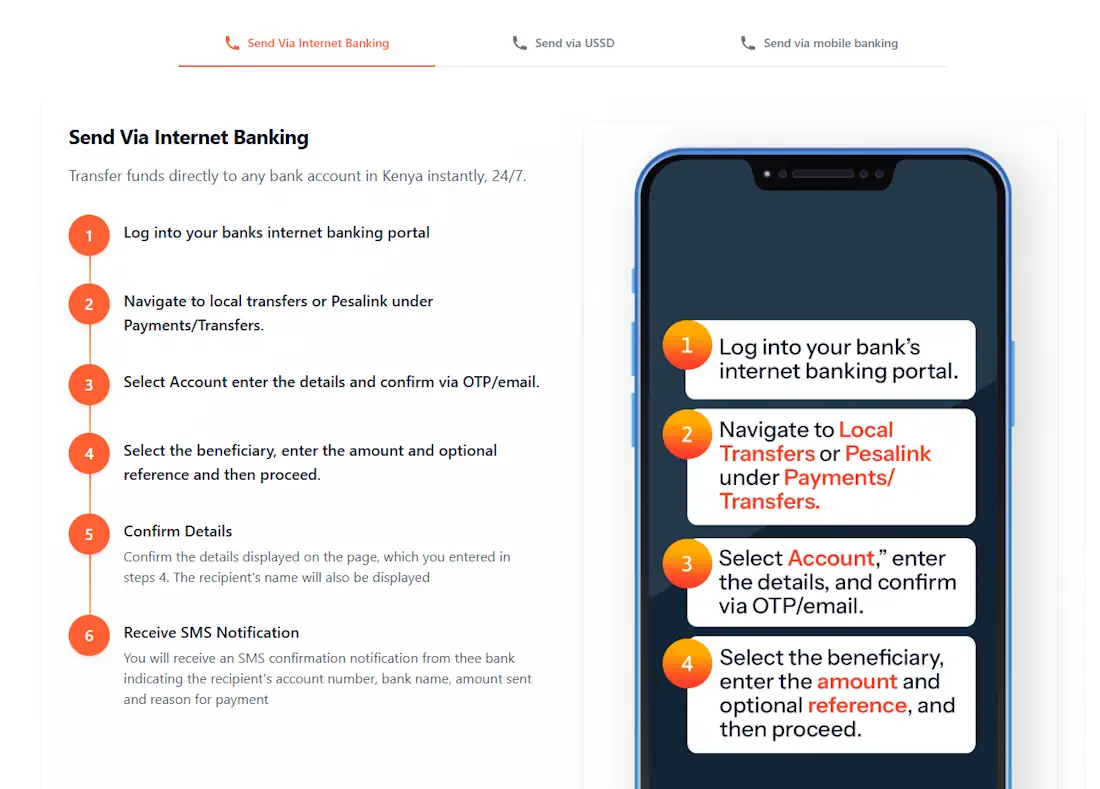

Step-by-step via online banking

The quickest way to make a pesalink deposit might be through internet banking:

- Log into your bank's internet banking portal

- Look for "Local Transfers" or find the "PesaLink" option under Payments/Transfers

- Select your account, then enter the recipient's details

- Choose the beneficiary, input the amount, and add an optional reference

- Verify all details displayed on the confirmation page

- Complete the transaction and wait for the SMS confirmation

Standard Chartered customers should create a beneficiary before making transfers through their online banking platform.

Step-by-step via mobile app

Bank apps give you easy access to pesalink sites in Kenya:

- Open your bank's mobile banking app and log in

- Tap on "Transfers" or "Payments" and select "PesaLink"

- Choose "Send to phone" or "Send to Account" based on your preference

- Input the recipient's mobile number or select their banking institution

- Enter the transfer amount and add a reference note if prompted

- Confirm the transaction details and submit

Equity Bank users should start by selecting "My Money" followed by "Send Money" on the Equitel menu.

Step-by-step via USSD

USSD remains essential for people without smartphones:

- Dial your bank's USSD code (e.g., *522# for KCB, *722# for SCB)

- Enter your PIN and select the PesaLink option

- Choose "Send to Phone" or "Send to Account"

- Enter the recipient's mobile number or account details

- Input the amount and reason for payment

- Review and confirm all transaction details

You'll get confirmation SMS messages from both your bank and PesaLink when done.

Tips for first-time users

Here are some helpful tips before your first PesaLink transaction:

- Register first: Most banks need you to register for PesaLink once before you can transfer money

- Check limits: You can transfer between KES 10 and 999,999 per transaction

- Keep receipts: Save those SMS confirmations as proof of payment

- Verify recipient details: Make sure account numbers and bank details are correct before you confirm

- Know the codes: Learning bank codes helps speed up your transactions

PesaLink shines because it works instantly and gives you options for how to send your money.

PesaLink fees, limits, and transaction times

PesaLink offers transparent pricing and fast processing times that Kenyan bank customers find attractive. Take a closer look at how the service works to see what you can expect from your transactions.

Minimum and maximum transfer amounts

PesaLink gives you flexible transaction options. You can send any amount from KES 10 to KES 999,999 in one transaction. The service also supports other currencies. Minimum transfers start at USD 1, GBP 1 and EUR 1, while maximum limits reach USD 10,000, GBP 10,000 and EUR 10,000. These ranges make PesaLink perfect for small daily transfers and large business payments.

Fee structure by amount range

Your PesaLink fees depend on your bank and transfer amount. Here's a breakdown of typical charges:

| Transaction Amount (KES) | Standard Chartered | KCB | Bank of Africa |

|---|---|---|---|

| 10 – 500 | Free | Free | Free |

| 501 – 1,000 | KES 40 | Free | Free |

| 1,001 – 5,000 | KES 40 | KES 36 | KES 30 |

| 5,001 – 10,000 | KES 40 | KES 48 | KES 50 |

| 10,001 – 50,000 | KES 80 | KES 63.25 | KES 100 |

| 50,001 – 100,000 | KES 120 | KES 96 | KES 110 |

| 100,001 – 200,000 | KES 160 | KES 120 | KES 180 |

| 200,001+ | KES 200–250 | KES 240 | KES 180–200 |

How long it takes for funds to reflect

PesaLink is characterized by its speed. Money reaches the recipient within 45 seconds. The service maintains this speed even on weekends, after business hours and on holidays. The system automatically returns failed payments to the sender's account within 45 seconds.

Are there charges for receiving money?

Recipients don't pay any fees to receive money through PesaLink. This rule applies to all banks using the service. You can receive money without worrying about fees being deducted from the amount.

Is PesaLink safe and reliable?

Security plays a vital role in my experience with PesaLink deposit services at pesalink sites in Kenya.

Security features in place

PesaLink's infrastructure uses enterprise-grade security with multiple layers of protection. The system comes with end-to-end encryption and maintains a remarkable 99.99% annual uptime. Two-factor authentication provides peace of mind during transactions. Businesses benefit from PesaLink's elastic infrastructure that grows with transaction volumes. The platform runs on back-up systems in multiple data centers. The Central Bank has established cybersecurity guidelines as part of the National Payments Act. These policies control incident management and coverage.

What to do if a transaction fails

PesaLink automatically returns funds to the sender's account if a transaction fails. Most transactions are instantaneous, but sometimes there are delays. In such cases, funds are usually returned within 72 hours. The platform verifies recipient details before completing transactions, which helps reduce errors.

Customer support and dispute resolution

You should contact your bank immediately if you have any problems. PesaLink offers round-the-clock technical support and live assistance to solve problems. The platform has strong security measures, but keep in mind that banks don't take responsibility for losses caused by input errors.

Our Verdict

PesaLink has changed banking in Kenya with its fast 24/7 money transfer system. I've used the service extensively and have found it to be great for sending any amount between KES 10 and KES 999,999. More than 80 financial institutions now use the system, making it available to more people across the country.

M-Pesa may be Kenya's favorite, but PesaLink is a great option if you need to move money between bank accounts. You can use it through mobile apps, USSD codes, ATMs, or bank branches, so you can send money however you prefer.

PesaLink shows how far Kenya's digital payment system has come. I've used it many times for various transfers and can say that it's a must-have tool if you have a Kenyan bank account. It's fast, it's secure, and it's available to more people - PesaLink has made moving money between banks so much easier.